MARKET ANALYSIS MECHANICAL ENGINEERING GERMANY: TOP 100 RANKING

The new market analysis "Mechanical Engineering Germany 2025" by MEYER INDUSTRY RESEARCH, published in November 2025, provides an overview of the 100 leading mechanical engineering companies in Germany, their revenue and employee figures, as well as data on the industry's profitability. The study is available for free download on our website.

Industry diversity – from global players to hidden champions: Whether machine tools, packaging machines, or plastics and rubber processing machines – German machine manufacturers are among the leaders in the global market. Our market study of the top 100 machine manufacturers in Germany highlights well-known global players such as GEA, Voith, and KUKA. At the same time, our ranking of Germany's leading mechanical engineering companies also includes numerous hidden champions, which also employ hundreds or thousands of people and are among the global market and technology leaders within their machine categories.

MATTHIAS MEYER, MANAGING DIRECTOR OF MEYER INDUSTRY RESEARCH, ON THE MARKET STUDY

"In our market analysis projects, we repeatedly see how diverse the corporate landscape in mechanical engineering is and how strongly individual market segments are characterized by specialized hidden champions. International investors have frequently invested in German mechanical engineering companies in recent times. Against this backdrop, we wanted to take a closer look at the high-performing German companies behind them and have compiled a ranking of the top 100 German mechanical engineering companies. We believe that our market study on the leading mechanical engineering companies can be a helpful source of information for our customers and prospective customers."

CHALLENGING TIMES FOR GERMANY'S TOP 100 MACHINERY MANUFACTURERS

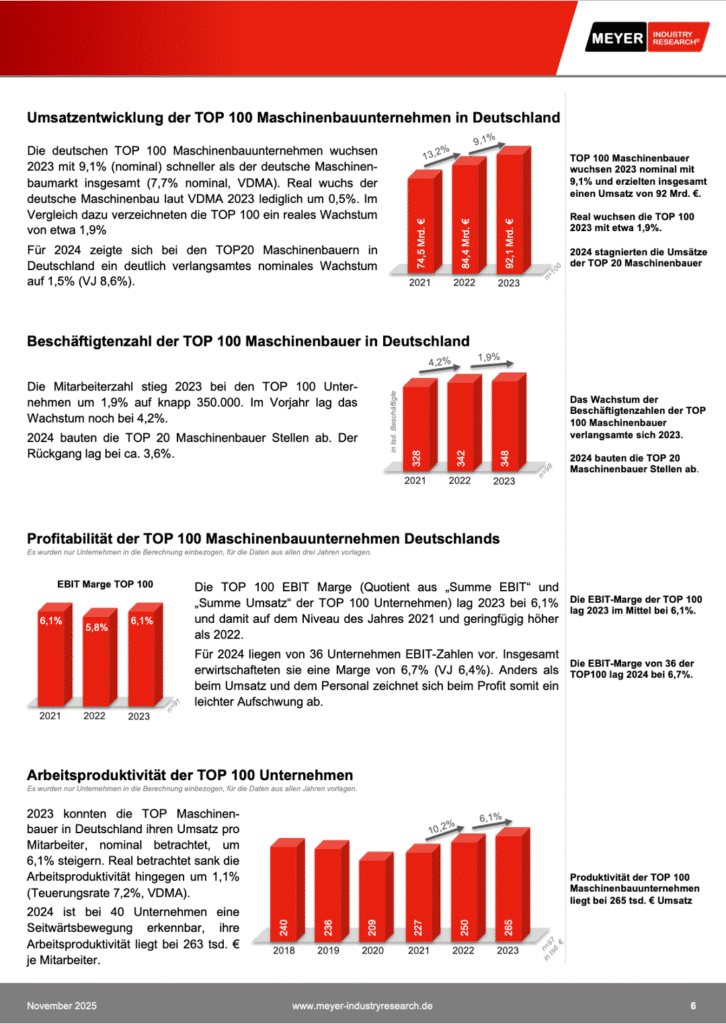

Growing sales: The top 100 German mechanical engineering companies grew by 9.1% nominally in 2023. In real terms, growth was 1.9%. Significantly lower growth is expected for 2024, both nominally and in real terms.

Stagnant to declining employment: The number of employees at the top 100 mechanical engineering companies rose by 1.9% to approximately 348,000 in 2023. Compared to 2022, growth slowed significantly, reaching 4.2% the previous year. This trend appears to be continuing, as the number of employees at the top 20 mechanical engineering companies decreased by 3.6% in 2024.

Stagnant profits: The average EBIT margin of the top 100 mechanical engineering companies was 6.1% in 2023. Compared to previous years, this represents a sideways trend in profitability (previous year: 5.9%). A slight increase in the EBIT margin of the top 100 companies is expected for 2024. Profit figures for 2024 are available for approximately one-third of the companies. These achieved an average margin of around 6.7%.

Increased labor productivity: In 2023, the top 100 machine manufacturers increased their labor productivity (revenue per employee) by 6.1% compared to the previous year, reaching approximately €265,000. However, taking into account the inflation rate of 7.2% over the same period, real labor productivity decreased by 1.1%. For 2024, we anticipate that nominal labor productivity will remain stable.

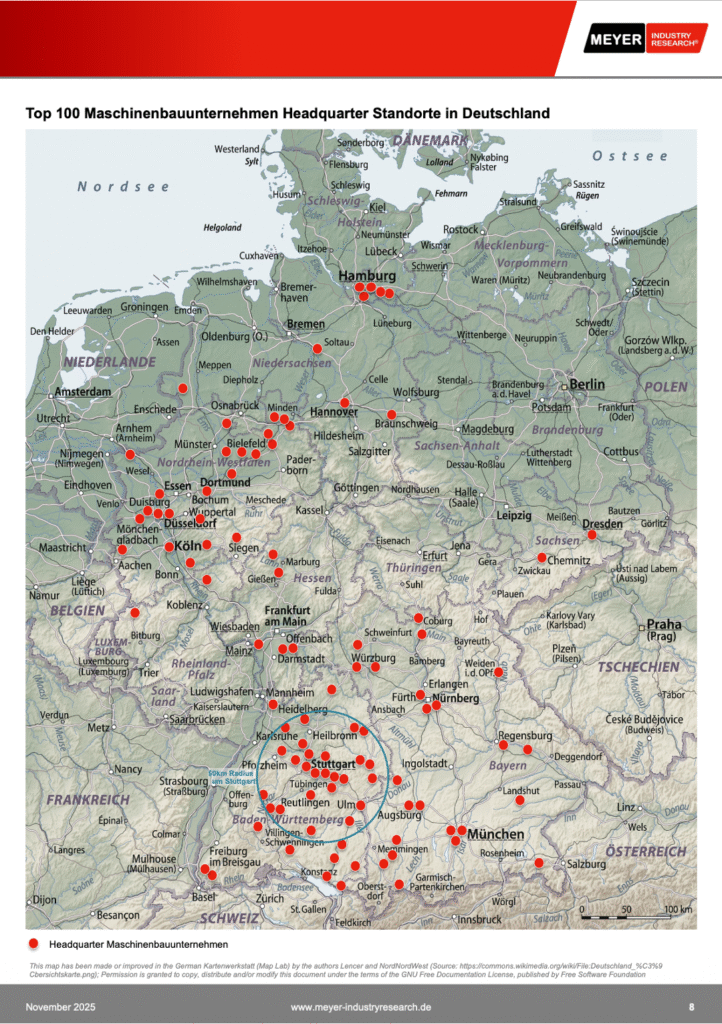

REGIONAL DISTRIBUTION: STUTTGART CONFIRMED AS HOT-SPOT OF GERMAN MECHANICAL ENGINEERING

The heart of mechanical engineering beats in three German states: 82 of the top 100 companies are headquartered in Baden-Württemberg, Bavaria, or North Rhine-Westphalia. Hesse (5% of companies) and Lower Saxony (4% of companies) are also important locations for German mechanical engineering.

Christian Scherer, Automotive Analyst at MEYER INDUSTRY RESEARCH and co-author of the study, comments: “The hot spot of German mechanical engineering is clearly in the Stuttgart region. Within a 50 km radius of Stuttgart, 25 of Germany’s 100 largest mechanical engineering companies are located. On our map of headquarters, Swabia is densely populated with large mechanical engineering companies.”

MARKET RESEARCH AGENCY FOR MARKET ANALYSIS IN INDUSTRY AND TECHNOLOGY

MEYER INDUSTRY RESEARCH specializes in the creation and implementation of market analyses automotive, mechanical engineering, medical technology, energy technology , and electronics sectors, we develop fact-based and reliable decision-making bases with our professional market analyses.

The market analyses we prepare for companies serve our clients as a profound basis for strategy projects, market entry plans , and mergers and acquisitions (M&A).

INDIVIDUAL CONSULTING FOR YOUR COMPANY ANALYSIS

Trustful personal cooperation and the high quality and reliability of our analyses are top priorities at MEYER INDUSTRY RESEARCH.

We would be happy to provide you with an in-depth, non-binding consultation prior to a potential collaboration with a market study, including a personal on-site consultation upon request. We look forward to receiving your inquiry and will be happy to prepare a customized quote for you!