MARKET ANALYSIS – TIPS AND PRACTICAL EXPERIENCE

Why do you need a market analysis?

If your company operates in a highly dynamic market with new competitors, changing customer requirements or a high level of innovation , a market analysis can help you to position your company successfully in the market, to make targeted use of new opportunities in the market and to be prepared for future requirements.

Our fact sheet on systematic market analysis shows typical use cases, success factors, and common mistakes in practice:

What is meant by a market analysis (definition of market analysis)?

What is a market analysis? A market analysis examines a regionally and objectively defined market in a structured manner based on defined evaluation criteria .

The criteria examined are typically general market data such as market volume/market size, growth/market forecast, competitors, their market shares, and other market participants, trends, or general information on the competition, customers, and target groups of the market . The selection of criteria and relevant data takes place in the conceptual phase of the analysis.

Systematic market research serves to reliably assess strengths and weaknesses, as well as its opportunities and threats, within the market. It can cover an entire market or a specific niche and can be conducted by established companies or as part of a startup.

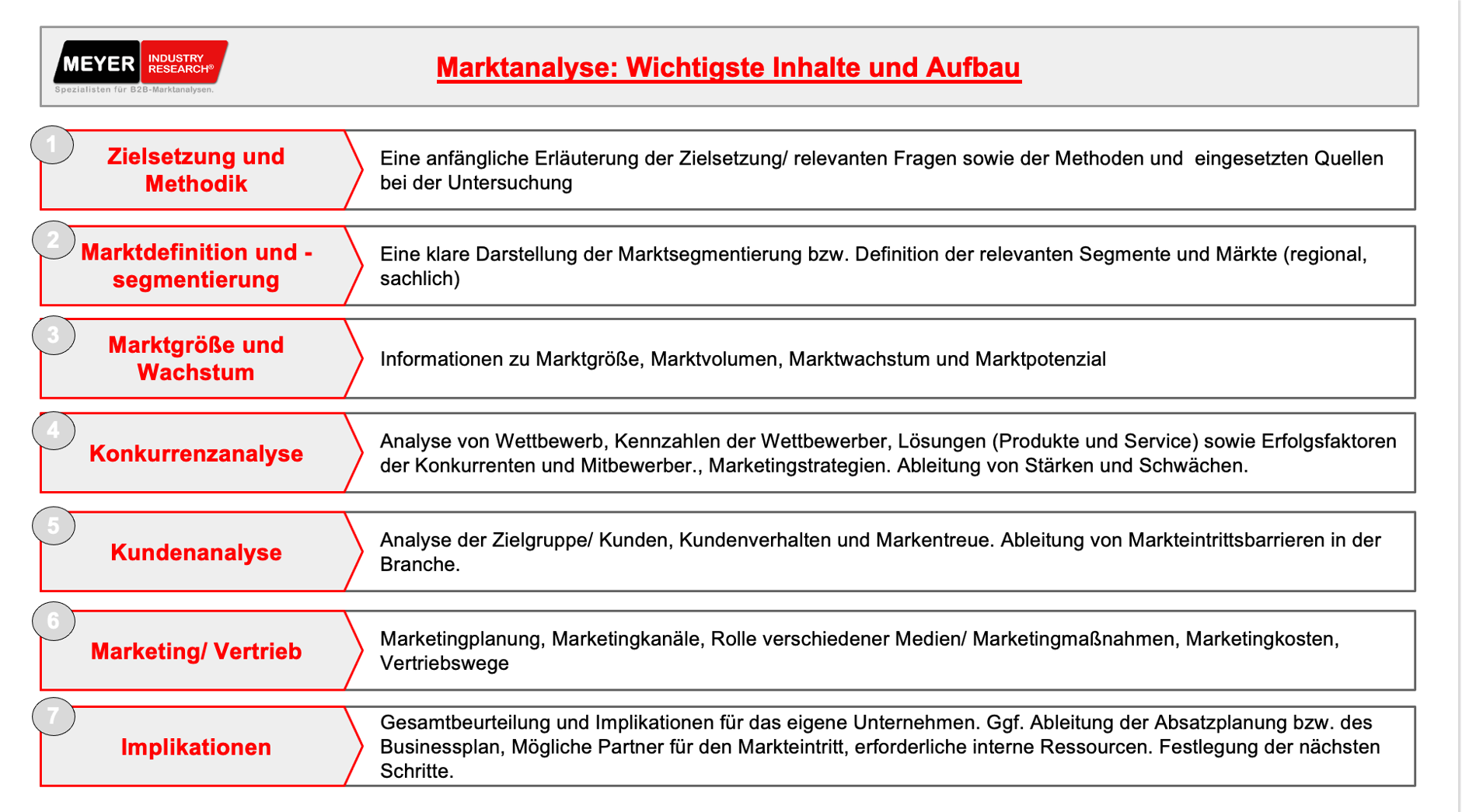

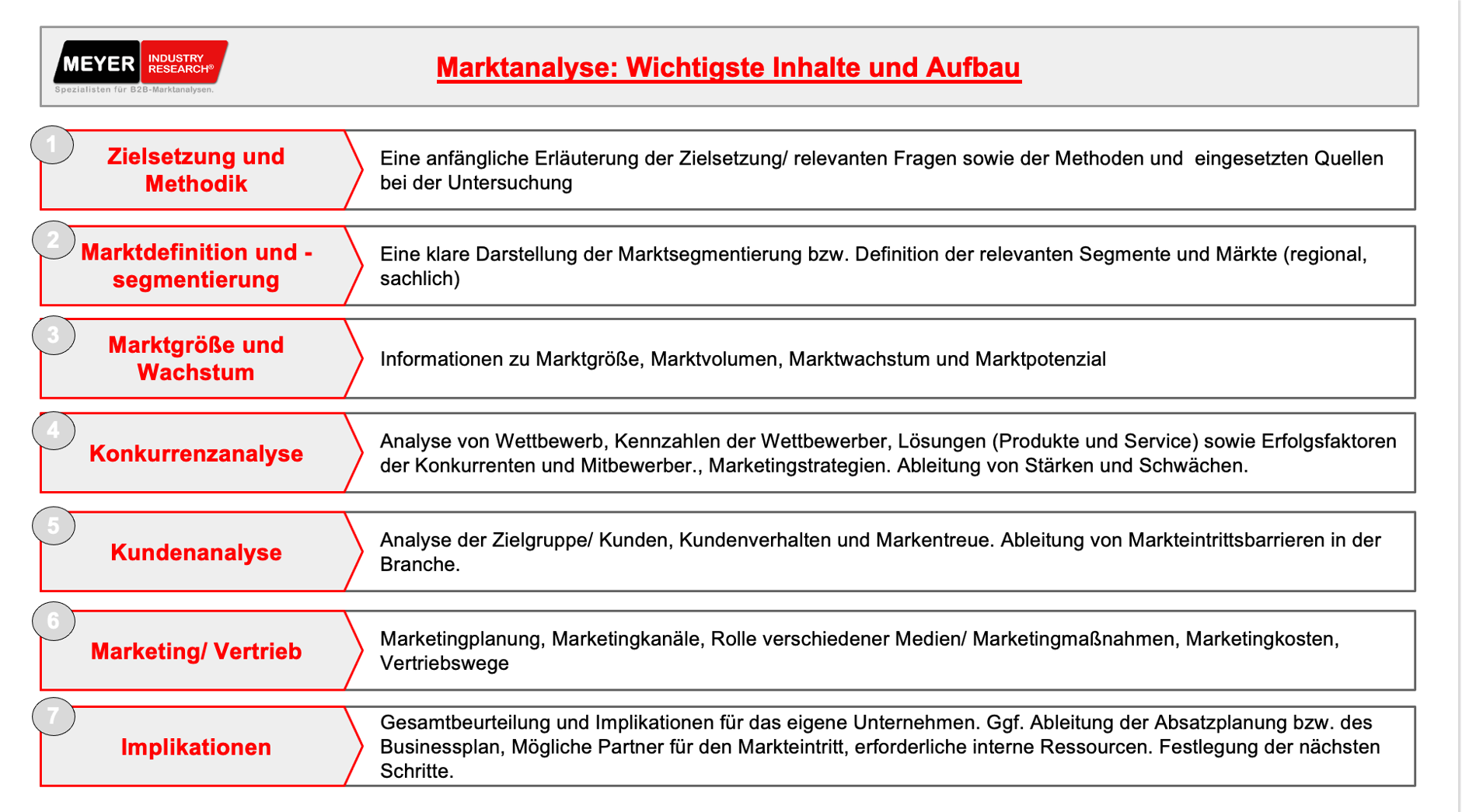

Market analysis: content and structure (components of market analysis)

The adjacent fact sheet shows an example structure with the most important contents of a strategic market analysis: A systematic market analysis evaluates a defined target market with regard to relevant attractiveness criteria such as market size, expected future development, competitive situation, customer requirements and trends in the market .

A market and competitive analysis provides a structured overview of market opportunities and risks fact-based assessment of potential strategic market development options for the company, enabling it to operate profitably and sustainably in the market. Ideally, it therefore serves as a compass for company management , enabling targeted management in a dynamic and rapidly changing market.

The advantages of a market analysis – what opportunities does a market analysis offer?

Systematic market analyses are therefore particularly valuable where markets, competitors, and customer requirements are undergoing significant and dynamic change . This change leads to the disruption of established structures, new opportunities and risks, and therefore reliable information is particularly relevant.

Even though the term "disruption" is certainly overused, the current changes are leaving hardly any industrial company untouched. Attractive opportunities are currently emerging in the following sectors, for example:

THE MOST IMPORTANT QUESTIONS ABOUT MARKET ANALYSIS – AND OUR ANSWERS

HOW TO CREATE A MARKET ANALYSIS (Market Analysis Procedure)

The possibilities for obtaining strategically relevant information have improved considerably over the past decade. The amount of available information on markets and companies has grown exponentially. Search engines, databases, and analysis tools have significantly improved, so that the experienced analyst today has options at his disposal that were unimaginable 10 years ago.

However, in practice, there are still some limitations in obtaining market and company information for systematic market analysis:

Should you conduct a market analysis or trust your gut feeling?

Tilmann Betsch, Professor of Social, Organizational and Business Psychology at the University of Erfurt, says:

"In situations where we have very positive experiences, we can also rely on our feelings. As long as intuition is based on a lot of solid information, it is likely to lead us in the right direction. When circumstances change and things deviate from the norm, however, intuitive decisions can be more likely to lead us astray."

In new and dynamic situations, a systematic analysis of a market is the basis for important decisions for entrepreneurs, strategic decisions in product development, sales and marketing as well as for larger investments such as a planned market entry.

Consistent and consistent market monitoring , ideally taking the target market into account and including a competitive analysis , is a key foundation for business success. Only in this way can movements in the target group, for example, toward a new technology, be identified early on. Knowledge of the target market also forms the basis for targeted marketing efforts. Likewise, long-term market and competitive monitoring uncover shifts in market potential within the industry, allowing countermeasures or solutions to be developed early on. These are just a few examples of how business policy benefits from the information provided by a structured market analysis .

DO YOUR MARKET ANALYSIS YOURSELF OR HAVE IT CARRIED OUT BY EXPERTS?

- If your company has experienced employees and sufficient time available, a market and competitive analysis can generally be carried out by your own resources with good planning.

- Especially when it comes to important decisions of strategic relevance for the company or high investment volumes that are associated with the issue being investigated, cooperation with specialized market research companies such as MEYER INDUSTRY RESEARCH is recommended.

- For founders who want to take their business idea to the next level , it's also a good idea to outsource the analysis to avoid "bias," or the risk of viewing the market exclusively through their own lens. This is particularly important in markets with low market transparency.

Depending on whether the primary objective of the study is to build and expand a company's brand, define target audiences, address competitive issues, identify developments, trends, and market share, or raise capital, the content of the analysis can vary accordingly. By specifically addressing the focused topic, the time and effort required remain comparatively low. MEYER INDUSTRY RESEARCH offers customized, cost-effective solutions specifically for startups.

REFERENCES OF OUR MARKET ANALYSIS AGENCY

Managing directors, sales managers, and strategy and business development managers at more than 100 client companies rely on our meticulous market analyses for one key reason: the uncompromising quality and reliability of our market research results. Our discerning clients also value the personal and open collaboration with our professional market research team in Munich , as demonstrated by their numerous testimonials – please see for yourself.

WE ARE YOUR PARTNER FOR SUCCESSFUL MARKET ANALYSIS

"Market analysis, or systematic market analysis in the industrial sector, is a central component of strategic corporate management and the basis for sound decisions regarding products, services, and business developments. It provides reliable information on market structures, market potential, market development, reference markets, global trends and trends within the industry, as well as the target group, demand trends, and the position of the competition.

More and more companies, including those in the industrial sector, are realizing that comprehensive market analysis is essential for success in increasingly competitive markets. It enables companies to identify opportunities, minimize risks, identify customer needs, and thus assert themselves in the long term.

We would be happy to be your partner in conducting your successful market analysis!”

INDIVIDUAL CONSULTING FOR YOUR COMPANY ANALYSIS

Trustful personal cooperation and the high quality and reliability of our analyses are top priorities at MEYER INDUSTRY RESEARCH.

We would be happy to provide you with an in-depth, non-binding consultation prior to a potential collaboration , including a personal on-site consultation upon request. We look forward to receiving your inquiry and will be happy to prepare a customized quote for you!